|

|

| Home Top Stories Technology / Education Events & News Association Designs |

|

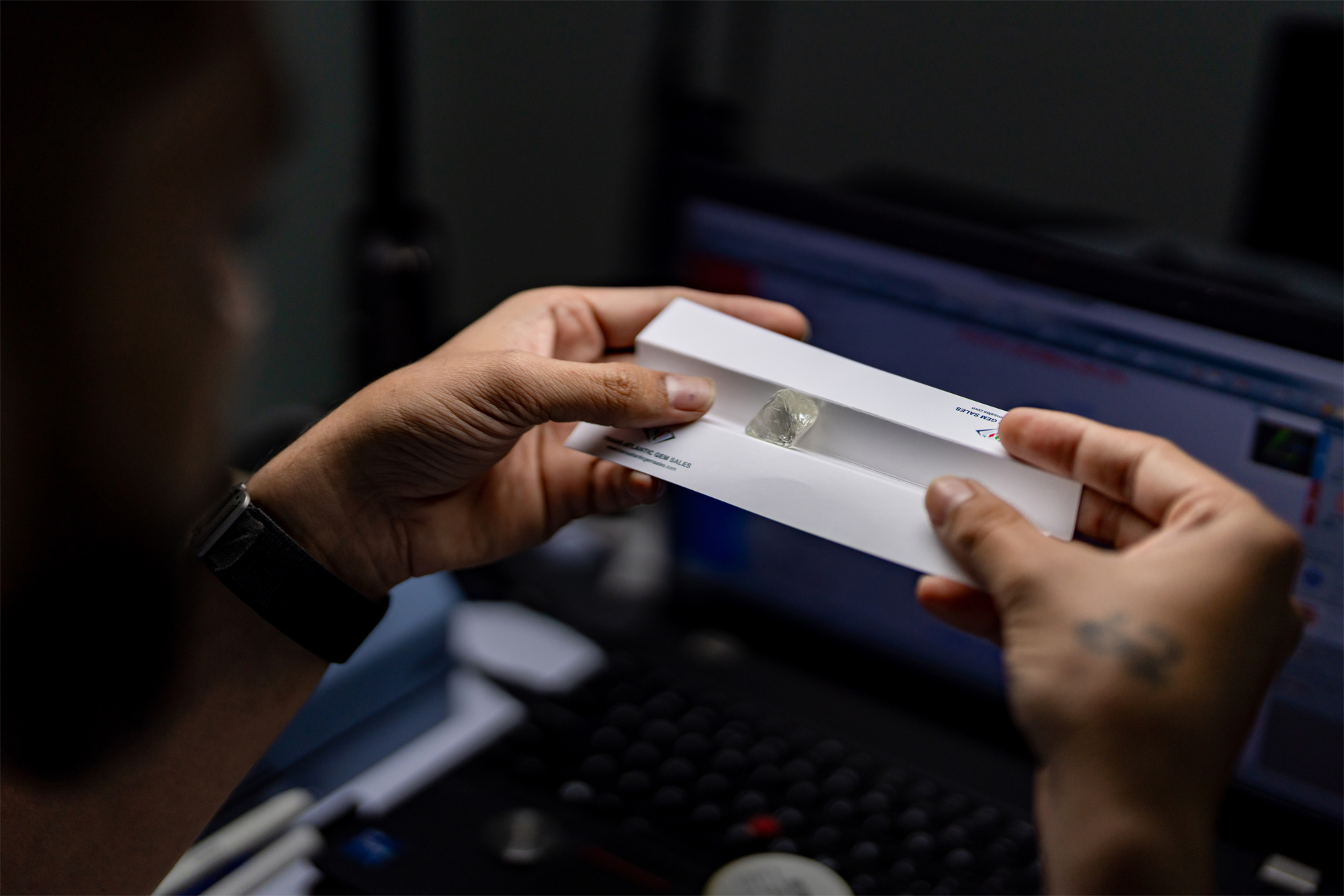

TRANS ATLANTIC GEM SALES

DUBAI TENDER REPORT - DECEMBER 2023

With Indian Diwali holidays now over the markets are gearing up for the important Christmas sales period. In recent weeks some tender houses have cancelled or postponed sales, De Beers have allowed full flexibility to buyers and consequently presented some of their smallest Sights in November and December. Additionally, India imposed a voluntary ban on rough imports for 2 months which ends on 15th December, and Alrosa announced a reduction in sales, the impact of which remains unverified. The collective and substantial effect of these measures have had an impact on a bloated pipeline, and gaps in polished inventory are now beginning to appear. Polished prices in recent months have continued their fall as manufacturers have been obliged to stimulate demand and move stock. Rapnet Diamond Index is reported to have fallen by 38% over the past year following the steep increases seen post pandemic in 2021-2022. The current situation however shows a marginal improvement. While US economic weakness, a sluggish Chinese market, and LGD remain challenges going forward, the past weeks have seen a small increase in rough demand, and polished prices appear to have stabilised, and in some cases evidenced small increases. Polished sales during October and November in both the US and Hong Kong markets were above expectation, and there is a degree of optimism for the upcoming festive season. While we cannot consider ourselves to be through all the problems, we are perhaps witnessing the first ‘green shoots’? TAGS Tender: We welcomed around 85 companies from all the major centres, although understandably very few of our Israeli customers were in evidence. Following the postponement of last months tender TAGS presented the regular range of Southern African goods across the sizes, this included a significant number of stones above 10cts. In terms of activity during the event, we witnessed an uptake in interest to view compared to recent months, and this was reflected in increased bidding activity. The impending controls regarding Russian diamond exports might also have encouraged manufacturers to try and prepare for any potential slowdown in availability in the coming months. In line with reports from other recent tender sales, prices showed a slight improvement on recent months, but many customers remain cautious that this reflects gaps in manufacturers inventory rather than any significant change in market conditions. Overall, we believe rough stocks remain sufficient to fulfil immediate demand and only at the end of January will the true picture become clearer. In summary, we are pleased to report sales to 45 companies with sales more than 70% of value presented.

|