|

|

| Home Technology / Education Events & News Archives Designs |

|

GLOBAL TRADE DEFIES EXPECTATIONS IN 2021 AND DRIVES RECOVERY, FINDS LATEST DMCC REPORT ON THE ‘FUTURE OF TRADE’

• The US-China relationship will be central to the shaping of global trade Global trade will rebound in 2021 after showing surprising resilience in 2020 despite the economic challenges posed by the pandemic, according to DMCC’s latest special edition Future of Trade 2021 report titled, 'Defying predictions and driving the post-pandemic economic recovery'.

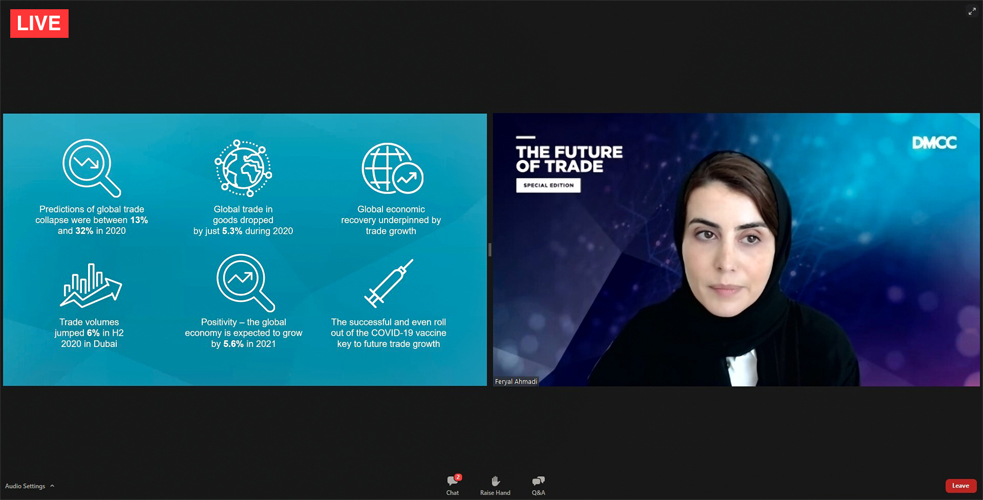

The report released today highlights two key global and regional takeaways: firstly, global trade will underpin strong global economic growth in 2021 and beyond, with the US and Chinese economies leading the way. This growth has defied expectations of double-digit annual declines, which had been estimated between 13-32% by the World Trade Organisation. Secondly, Dubai, a major trade hub, saw its foreign trade growth rebound significantly in 2020, despite the economic challenges posed by the COVID-19 pandemic, with the second half of 2020 seeing a particularly strong jump in trade volumes, of 6% year-on-year. Dubai’s overall export values jumped 8% in 2020, on an annual basis.

Ahmed Bin Sulayem,

Ahmed Bin Sulayem,Executive Chairman and Chief Executive Officer, DMCC According to the research, the most transformative element of the global trade outlook is technology. Blockchain, decentralised finance (DeFi) and other new and disruptive technologies will further accelerate trade growth. For example, DeFi protocols have seen a considerable amount of funds invested. Since the start of 2021 alone, the total value locked into DeFi has tripled from approximately USD 20bn to USD 60bn. As digital infrastructures grow, they will continue to accelerate a ground-breaking shift in trade from the national to the global.  Feryal Ahmadi,

Feryal Ahmadi,Chief Operating Officer, DMCC On the geopolitical front, fears of protectionist policies persist and are propelled by ongoing US-China trade tensions, rising economic nationalism, and the widening economic disparity between lower and middle-income economies. Alongside this, in a significant development for sustainability and global trade, the EU’s drive to harness a carbon pricing practice, under the anticipated Carbon Border Adjustment Mechanism (CBAM), or “Carbon Pricing”, has been criticised as a form of protectionism, and as such, has the potential to further exacerbate existing geopolitical tensions. The findings suggest that while a 'new age of protectionism' is a key risk in the wake of the pandemic and increasing discussions around US-China decoupling, outright protectionism will be kept at bay because it is costly, unpredictable, and impacts jobs. Instead, economic nationalism is more likely to occur. While there were fears that the pandemic would see sustainability drop down the political and corporate agenda, that has not been the case. Rather, China, Japan, the US, South Korea and Canada are among nations to have announced more aggressive net zero targets. Further, companies and investors have ramped up their sustainability efforts and they are set to grow exponentially in the years ahead. For its part, CBAM has the potential to significantly disrupt international trade and raises questions around how to accurately measure emissions from complex supply chains. Once again, technology and artificial intelligence may provide at least part of the answer for companies and governments seeking to make accurate assessments relating to sustainability within their trade agendas.

The Future of Trade report puts forward a number of key recommendations to business and government:

During the launch event, global trade experts joined a panel discussion to share their views on the report. Panellists included Khatija Haque, Head of Research & Chief Economist, Emirates NBD; Roberta Piermartini, Chief of Trade Cost Analysis, World Trade Organisation; Yanislav Malahov, crypto and blockchain technology expert and Founder of Aeternity; and Marcus Treacher, Chief Executive Officer of CB Investment Growth Holdings and Board Member of Clear Bank and RTGS Global.

|