|

Global gold-backed ETF holdings retreated in February

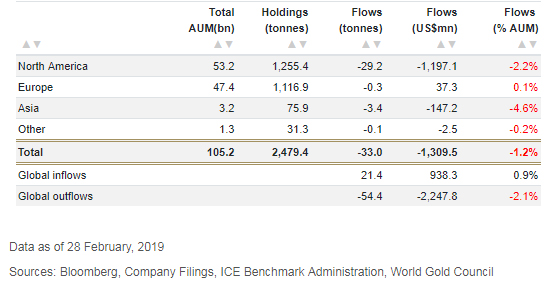

After four straight months of inflows, holdings in global gold-backed ETFs and similar products fell in February by 33 tonnes(t) to 2,479t, equivalent to US$1.3bn in outflows. Global assets under management (AUM) fell by 2% in US dollars to US$105bn over the month. However, global gold-backed ETF flows remain positive on the year (US$1.7bn, 2% AUM) on the back of strong inflows in January. After four straight months of inflows, holdings in global gold-backed ETFs and similar products fell in February by 33 tonnes(t) to 2,479t, equivalent to US$1.3bn in outflows. Global assets under management (AUM) fell by 2% in US dollars to US$105bn over the month. However, global gold-backed ETF flows remain positive on the year (US$1.7bn, 2% AUM) on the back of strong inflows in January.

Regional flows

•North American funds had outflows of 29t (US$1.2bn, 2.3%AUM)

•Holdings in European funds were flat (tonnage loss but fund inflows) -0.3t (+US$37mn, 0.1%)

•Funds listed in Asia decreased by 3t (US$147mn, 4.6%) Other regions were virtually flat, falling by 0.1t (US$2.5mn, 0.2%)

Individual flows

•In North America, SPDR® Gold Shares led global outflows, losing 40t (US$1.7bn, 4.8%), while iShares Gold Trust added 7t (US$299mn, 2.4%) followed by SPDR® Gold MiniShares adding 3t (US$122mn, 24%)

•European inflows were led by ETFS EUR Daily Hedged Gold and Invesco Physical Gold, both of which added 2t or ~US$90mn. ETFS Physical Gold, in the UK, had outflows of 3t (US$106mn, 1.5%)

•In China, Huaan Yifu had significant outflows of 3t (US$121mn, 10%)

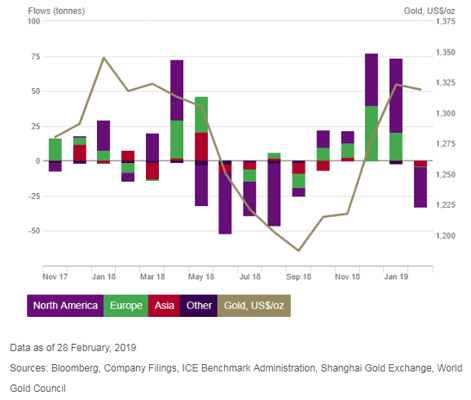

Monthly flows

**Note: We calculate gold-backed ETF flows both in ounces/tonnes of gold as well as in US dollars because these two metrics are relevant to understand the performance of the funds. The change in tonnes gives a direct measure of how holdings evolve, while the dollar value of flows is a finance industry standard that gives a perspective of how much investment is reaching the funds. This month, the reported flows measured in tonnes of gold and their dollar value equivalent seem inconsistent across regions. Both figures are correct. The difference is the result of the interaction between the performance of the gold price intra-month, the direction of the dollar, and the timing of the flows. For example, Europe experienced outflows early in the month when the price of gold was low but gained assets later in month when the price of gold increased.

***Low-cost US-based gold backed ETFs are defined as gold-backed ETFs, trading on US markets that have annual management fees of 20bps or less.

Goldhub: the definitive source of gold data and insight.

Register on Goldhub, to gain access to interactive charts, tools and data to help you analyse the gold market.

|